General

A JHM Exclusive: A Full Transcript of Yesterday’s Comcast Press Conference

Well, given that these folks could turn out to be the new bosses of the Walt Disney Company, Jim Hill thinks that we should all learn a bit more about Brian Roberts and Steve Burke. Which is why he prepped this transcript.

I know, I know. This is kind of a departure from the usual way that JimHillMedia.com is run. One story instead of three. But I don’t need to tell you folks that these are pretty unusual times.

And given that most of us didn’t really know much about the Comcast Corporation ’til yesterday morning, I thought that it was important that we all make an effort to learn a little bit more about this company. More importantly, what their intentions toward the Walt Disney Company are.

So — toward that end — I spent most of yesterday working up a transcript of the Comcast press conference. You know, the public meeting NYC where this Philadelphia-based firm revealed that it intended to pursue a somewhat hostile takeover of the Walt Disney Company.

There’s lots of interesting tidbits buried in this document. News about how long Comcast officials think a merger with Disney would take to get government approval (A year to nine months), whether reaching out to Pixar is a part of their plan (You bet!) as well as the corporation’s plans to revive and revitalize Disney Feature Animation as well as the Disney theme parks.

So dig on, folks and learn all that you can about Comcast. There’s really some fascinating reading here. That is — of course — if you can get past all the “Ums” and “You Knows.”

DAN COHEN: Good morning everyone. My name is David Cohen. I’m executive vice president of Comcast Corporation. I want to welcome you to this press conference. Joining me on this stage are Brian Roberts, the president and CEO of Comcast and Steve Burke, president of our cable division. Also with us in the audience is Ralph Roberts, the founder and chairman of the executive and finance committee. John Alchin and Larry Smith, Co-CFOs of Comcast Corporation. There are people joining us by telephone as well. So I’m going to turn the podium over to Brian, and Brian and Steve will take us through a brief presentation and then open the floor for questions. Brian?

BRIAN ROBERTS: Thank you, David. Good morning, everyone. We are proud and excited to be here to discuss Comcast’s proposal to merge the Walt Disney Company and Comcast together. This combination would create one of the world’s premiere entertainment and distribution companies and attempt to restore the Disney grand name to its prominence and the Disney Company to the growth through the marriage of content and distribution.

This is an incredibly compelling combination. There is simply no doubt in my mind and all of our folks here today that the two companies together are better than either apart by itself. We think that we can achieve things for our customers that will allow them to access the best of the Disney content, the best of the ESPN content, the best of ABC and Miramax and all the wonderful library and new content in the years ahead. Coupled with our cutting-edge state-of-the-art broadband technology — whether it’s to your television set or to your Internet connection — with Comcast high speed Internet.

So we truly believe that we will have created an entertainment communications leader. Let me now review — so everyone make sure we have the same facts — what the proposal is. We basically have offered 0.78 of a Class A voting share for each Disney common share. That will then result in Disney shareholders having 42% of the combined company. One of the real pluses is — by doing a stock-for-stock tax free deal — all shareholders now enjoy the combination benefits that will be created by putting this company together. We have invited, you know, several members of the Disney board to join the Comcast board and we really want to try and see if we can get the company off to a terrific start.

Let me review for you quickly the pieces of the two companies. So that you can see if you agree with the conclusion that — together — it would be one spectacular company:

Comcast today is approximately in 21.5 million cable homes, and we have our wire and our state-of-the-art fiber optic technology to close to 40 million homes past. We have 5. …We announced this morning our earnings results. We have 5.3 million high speed internet customers and 1.3 million telephone customers. So we have tremendous subscriber relationships in — at present — in 22 of the top 25 cities in America.

We have just completed the integration of AT&T Broadband the last 18 months. And I’m happy — Steve Burke will talk a little bit about this — to tell you that we are ahead of every single schedule. We reported earnings this morning and gave our guidance for 2004 where anybody and ourselves thought that we could get this quickly. The network is fully — 93% rebuilt and we have strong financial position. We have reduced by nearly 10 billion dollars the debt in one year that came with AT&T Broadband. We think we’re ready for the logical next step. And that — of course — is that of entertainment and content.

The Walt Disney Company is a leader in entertainment, obviously, with kids, sports, news and movies. The four most important areas for content for customers, whether they’re getting that content from television or any other medium. Obviously, the brands are legendary with Walt Disney and what they’ve created. And we’re very respectful and mindful of the incredible brand and the institution that is the Walt Disney Company.

Therefore, if you put the two together, you will have a company with those four categories, a potential to be a leader in all four spaces of family programming: film, news and sports nationally and locally with an unmatched technology platform in a very competitive business. Every one of their businesses is competitive and every one of our businesses is competitive.

The financial outcome — of course — would be a company that has substantial size, employees all over the country and the ability — I think — when you’re working together as one company to say “Okay. What creative ideas can there be and how can we accelerate giving them to customers on the other end?” Could you license it, could you work it two separate companies? Sure you can. But not the same as you can when you’re one company combined.

That — to me and to us — is what happens in the space that we operate in and we think that our company is ready for this rather large and dramatic next step. We’re very fortune — in order to figure out how to make it work that we have, who just handled our last large step, Steve Burke. President of Comcast Cable as David mentioned. Who worked at the Walt Disney Company for 12 years and has worked in three of the four divisions that Disney has in senior leadership roles. And Steve is very intimate with where Disney’s been, where Disney is and where it might go in the future. So it gives me great pleasure that one of the ways that we’re feeling optimistic about where we can take this company is the culture that we’ve created to attract people like Steve Burke. Who want to be at our company and who want to take the opportunities that this company can become. Steve?

STEVE BURKE: Thank you, Brian. I think the place to start is by looking at how the two companies — if they’re put together — are going to be stronger and more profitable and more successful than if they were kept apart. And we’ve identified two major categories of improvements that derive from putting these two companies together and I’ll go through each of them.

The first category is restoring the operating performance at the various Walt Disney Company divisions to where it was not too long ago. If you look at the ABC network and owned stations, ABC is a weak No. 4. Doesn’t make very much money in the broadcast business, despite the fact that CBS, Fox and NBC make between $800 million and $1.3 billion dollar a year. Our goal for all of these businesses — we believe — is reasonable. And that is if we get halfway to being the No. 3 network, ah, that would improve the profitability of the combined entity by $300 — $500 million. We believe that that’s a reasonable goal. And we have some ideas, specific ideas, about how to do that.

The second area which we feel we have real expertise is by improving the performance of the cable channels that the Walt Disney Company currently owns. If you look at the Walt Disney Company’s cable access, they’re fantastic access. However — if you drilled down and look at the Disney cable network group, and in particularly ABC Family which Disney paid over $500 million for just a couple of years ago …

ABC Family — by our calculations — is not making money, or making very little money. It’s certainly not a fair return on investment. We have some ideas about ways to improve those cable channels. It’s an area that we’ve been quite successful in over time with E! and QVC and the Golf Channel and our other various cable interests. We also think that we could be more helpful in terms of getting more distribution. Most clearly on our cable systems but also more broadly distribution from throughout the cable industry. So we think that there is a synergy potential, a value creation potential in terms of cable channels on the order of $200 — $300 million.

If you then drop down to what are the things we can do just by combining these two companies? What are the benefits that derive by putting these two great companies together? We think that there’s an immediate impact in terms of eliminating duplication in corporate and other overhead, economies of scale, so forth and so on, of between $300 — $400 million. We also believe that there are tremendous new business opportunities. So — in terms to the value creation that we’ve quantified — we think within a few years we can get between $800 million and $1.2 billion worth of value creation.

But — more importantly — I think we’ve identified a number of thing that we haven’t be quantified that we believe are ways that the Walt Disney Company’s operations could be significantly improved. And I’d like to talk about those on the next two slides. Again, these are not in the value creation numbers. But I think our feeling is that there’s a chance to reignite one of the world’s greatest entertainment businesses.

Now I’ll start with animation. If you look at the Disney animation business, until fairly recently, the Disney animation business was the unchallenged leader in the industry. It was the dream of every great animator to grow up someday and work for the Walt Disney Company. And if you looked at just the years 1991 to 1994 and you’d see titles like “Beauty and the Beast,” “The Little Mermaid,” “The Lion King” a little bit later on, but “Aladdin.” The type of movies that were made by Disney just 10 or even 5 years ago were fantastic.

Since about 1999, the Disney animated studios have not produced the kind of quality product. And our feeling is that the Disney animation business is absolutely central to the heart of what the Walt Disney Company is. And one of the first things that we would like to do is — if we’re fortune enough to put these two companies together — is do everything we can to empower the existing animation group to make sure that they feel like they’re right in the heart of the company.

And also to reach out to other companies who make animated, quality animated product like Pixar and others. To try to make sure that — over time — the Walt Disney Company regains its position as THE place for great children’s animation.

Animation drives the Walt Disney Company. It drives the success of the consumer products businesses and the theme parks. And we feel that it’s very, very important that that animation business be supported and cause it to thrive in the future.

The second area where we think that there’s room for revitalization and improvement are the Disney theme parks. It’s hard to think of a product or service in the United States that families love more than the Disney theme parks. And we believe that there are ways to revitalize those businesses, restore some of the creative spark to the attractions and hotel and concessions side of those businesses. And also cross-promote and advertise more aggressively.

On and off, all the properties that this combines, the company would have. None of those benefits are in our analysis. But they’re very much on our mind.

If you then look at a very important part of our thinking. It’s what can you do — let’s assume you make improvements to the Walt Disney Company’s operations — what can you do just by putting these two companies together?

The first and foremost area of priority, I think, will be launching successful new cable channels. This has been a big growth engine for the Walt Disney Company. It’s been a big growth engine for Comcast. And we believe by uniting all of those great brands and wonderful programming and movies and everything else with our distribution: 21 million subscribers, video subscribers and over 5 million high speed data subscribers … We oughta have the ability to create new cable channels. When a cable channel is created and works, it creates billions of dollars worth of value. And we think that is a very priority if we are successful putting these two companies together.

The second area … We believe that television is changing very rapidly due to the introduction of new technology. The cable industry is almost fully rebuilt. Digital technology is being rolled out on the cable side. The satellite companies are rushing to get more interactive features. And our feeling is the Disney library, the ESPN asset and — of course — ABC and all of its various properties could be tremendously valuable on these new platforms. And that’s a way to create value for the Disney assets. It’s also a way to create value for Comcast Cable.

We’re big believers in video on demand. We believe eventually people, the majority of people are going to have time shifting functionality. Whether it’s video on demand or PVRs like Tivo. We think that the Disney movies and attractive windows and video on demand makes a tremendous amount of success. We think time shifting ABC product … We’re doing this already in a number of our markets with NBC News, for example. and also various cable properties: Biography, Comedy Channel.

What we’re finding is people love the ability to pause, go backwards or fast forward with television. And we intend to give them that ability throughout our footprint. And I believe that most cable companies are going to try and do the exact same thing. So that should be a real opportunity. Now and — of course — ESPN and all of ESPN’s brands and the ability to make those interactive as television evolves that way.

But — as television is evolving — the same thing is happening with the internet side of our business. We have over 5 million high speed data customers. We believe we’re the biggest broadband provider in the world. And the ability to carry these wonderful brands with our broadband capacity and everyone else’s broadband capacity …

Wouldn’t be wonderful if you could have a subscription on demand package of Disney programming for your kids? Would people pay $9.95 a month for that? I know I would. I have 5 kids and the idea of being able to give them more Disney product would be very exciting for them.

But I think the same thing could be true for ESPN or ABC. All of those products, I think, are waiting to be further used on all of these new technologies for consumers benefit.

We also think that there’s a significant ability to leverage cross promotion if you put these two companies together. One obvious example we came up with; we happen to own the Golf Channel, Outdoor Life and three regional sport networks. And wouldn’t be great if those individual cable networks all had the ESPN brand associated with them? Wouldn’t it be great if you could cross promote viewership? And clearlythose assets — in our opinion — will be stronger together than they would be separately.

We also have 21 million subscribers and 5 million high speed data customers that we think there’s interesting potential to use our existing distribution to help promote the Disney theme parks. So lots and lots of ideas.

Again, on all the opportunities — which really is one of the major reasons why this deal makes sense for us and why we’re excited about it — we haven’t quantified any of these. Because I think it’s very hard to do and we can get plenty of savings without even trying.

If you then look at the track record of our company on the content side, I think the most dramatic example of value creation has gotta be QVC. QVC — the company that we sold our piece of for close to $8 billion recently — is the most dramatic example of how we’ve been able to create content assets that are very valuable.

But E! Entertainment, Style, the Golf Channel, Outdoor Life, the Comcast SportsNet. We’re launching a video game channel called G-4, another channel called TV One. This is an area of the business that we feel we understand. We have a proven track record. And we believe the combination of our expertise in handling assets and experience and the wonderful treasure trove of assets inside the Walt Disney Company would be a great thing for both companies and our shareholders.

If you then look at why we feel so confident that we can do this, I think if you look no further than what we’ve just gone through with AT&T Broadband. And Brian can take you through some of the facts and figures.

But we had our earnings call today, where we reviewed the year 2003. 18 months ago, there were a lot of people who doubted whether we could put AT&T Broadband — which was 1 1/2 times the size of Comcast — together with Comcast. And today — 18 months later — I’m pleased to say that integration process is now largely behind us.

Which is not to say that we won’t have further opportunities to grow and optimize our business in the future. We’re operating as one company with a largely rebuilt infrastructure with a company that has real momentum to go forward. And we are very confident that our company is ready to take on this additional challenge. Ready and excited about it. And also because the AT&T side of the business is in such good shape. And that the leveraging that Brian talked has happened. Now is the time.

Brian?

BRIAN ROBERTS: Thank you, Steve. One last slide and then we’ll go to questions.

Just to wrap it up. I think that Steve touched on a number of the obvious and exciting high points of what you would have when you put together these two companies. We really — bottom line — think accelerates the digital future. All content is going digital. Consumers can have access to it, be able to carry it around, get it over their computer, get it on their television. We think that we’re in the business of delivering that, competing for that opportunity with customers.

You need a management team that is willing to evolve and be creative. I think that Steve is unbelievable and deserving of cable operator of the year for what he accomplished with AT&T Broadband. Which just came out.

But it’s also Larry Smith and John Alchin who have been the financial discipline of the company for clearly 20 years. And the culture which my Dad and Junie Brodsky and Dan Aaron founded at Comcast. And you put it all together and we recruit folks like David Cohen — who was Chairman of the largest, fastest growing law firms in Philadelphia — want to join this company. And I just think we can keep making it better and better.

And so today’s step is a journey. But we think — hopefully — the Disney board will consider it and that we can make this a reality.

Now let’s go to questions.

Q: Who on the Disney board have you contacted and who’s been encouraging about (UNINTELLIGIBLE)?

BRIAN ROBERTS: I have not spoken to anybody on the Disney board.

Q: (UNINTELLIGIBLE) Have you ask them to join …?

BR: No. We just … In our letter that we wrote to Disney today, we said we’d be welcome several members of your board, whoever they would select or whatever … However we’d work that out as we go through the process.

Q: So no encouragement within the Disney …?

BR: We .. They had no communication from me, anyway, to anybody on the board. We felt that — something like this — gotta be public. There’s an awful lot of rumors. Yeah, I don’t think that this is a huge surprise. It’s a logical next step for Comcast to wanna get into content. And I think that Disney has said they want to use new technologies for their content. And — you know– there you have it.

Q: Can you talk about your conversations with Mr. Eisner and what his opposition is and what makes you think that’s surmountable opposition?

BR: Um. Well … I’ll just … These conversations, they were private. Private. But to simply say — as we said — it was made clear that it was not an immediate interest by Mr. Eisner to consider putting the two together.

We do think a number of the shareholders and perhaps member, board members, may look at that. And we want to make this as friendly as possible, as fast as possible. And we do believe that this is a very compelling offer to the shareholders of Disney.

This is a fair offer for both sides. It’s very hard in a deal to how to figure out how to get that balance just right. Wanna pay a big premium. $5 billion. Their stock has some run-up. It was as low as $15 as high as $25 in the last year. We’re paying … offered more than that. And — at the same time — we have a great company and we’re gonna be disciplined in how we approach this.

Q: When did you start talking to him and how many times have you talked to him?

BR: I don’t want to go into all that detail, if I could. Yeah?

Q: Some investors argue that you’re going to have to pay or offer $30 a share or higher to try and secure Disney. Are you prepared to do that?

BR: I think that our proposal speaks for itself. I don’t feel that there’s anything to be bashful about. I think it’s a very fair, respectful proposal. We hope that the board will consider it. I think that we have put, in every deal we’ve done, we’ve been a disciplined buyer and we’ve been a disciplined seller. And we’ve walked away.

In Media One, we didn’t succeed. In QVC — which we founded or helped found with Joe Siegel and build it from its infancy — when there was a compelling price, when Liberty offered us close-to-$14 Billion value for the company, for our piece, with $7.9 billion — we sold. In cellular, we bought in and later — even though it was in Philadelphia, our home town — we sold.

So I think one of the things that — I didn’t put a slide up but what we tell our investors is — we’ve been a public company since 1972. Since the day we went public, we’ve had a 21% compounded return to our shareholders for 32 years, 31 1/2 years. That’s double the Standard and Poor’s 500. We’re fortunate that Money Magazine picked us as one of the best five stocks sold in the last 30 years.

I think we’ve gotta do the right thing for all our shareholders. And — at the same time — I think we’ve made a very compelling, great succession plan. We’ll revitalize both companies better than they could be. The offer? It speaks for itself.

Q: (UNINTELLIGIBLE) Last offer? What would it take to (UNINTELLIGIBLE)?

A: I think that there are too many arbitrators in the room. The offer speaks for itself. I feel that’s the same question. Yeah?

Q: (UNINTELLIGIBLE) And also what you expect to get in return from Disney?

A: Well, the first part was about poison pills. I don’t believe that there are any of those at Disney. But their by-laws are public record.

Regarding second part was — anti-trust issues — Yeah, we believe that there is very clear laws that around the cable industry and the broadcast industry that address whether and how companies can come together in this fashion. There are rules that say — for instance — that you’re a cable company and you own programming, you must make that content available. The program access rules. That would apply to us. Which are what Newscorp just voluntarily agreed to do as part of their Direct TV acquisition.

David Cohen? Maybe you want to add to … Any other regulatory … But we believe that this can happen. And with the proper review and the appropriate review that’s afforded all these types of transactions.

DC: Thanks. You covered it.

Q: Can you discuss the extent to which your offer is opportunistic? In other words, is your timing in any way dictated by the turmoil that’s going in Disney right now? Would you be making this offer if this were not going on at this point?

A: Yeah, ya know … Ya know — in all business — there’s looking at all the factors that at the time. But — thankfully — this is a pretty compelling combination. I mean, if there’s no other message that I’d like to leave today, it’s how excited we are about what this company could be.

When’s best to put it together, how’s best to do it … You know, that’s all very important. But you gotta start with: Do you think this company could be something special? And we certainly do.

Earlier this week, I spoke with Michael Eisner. And he said “Not interested right now.” And that’s past.

There is — therefore — Today, we were announcing our earnings and our guidance for the full year. And this was something that was on our minds. And it, you know, the timing. You know, we want to tell our investors this was something that we might be doing and something we might be pursuing.

And so, you know, I don’t know how you ever explain timing. But I think that it has a lot to do with being told on Monday — or earlier this week — that it would either go not down this road or begin the process.

Yes, sir? Hang on. They want to wait ’til the mike gets there. So everybody can hear.

Q: Hi. Can you address ESPN. Obviously, ESPN has be able to consistently, you know, raise its rates every year. You know that, better than anybody. But there is some concern that thqt process might be getting to a end. And that maybe that raising power has peaked, at least in the short term. And it’s a such a key component of what you designed. Would you address that issue?

A: Sure. I think ESPN is a marvelous franchise. And it’s a lot of the reason that cable’s had this great success over the years. Along with some of the other early key brands that defined cable television.

Um, I think there’s an opportunity to enhance that product. There’s many ways to do things without just raising rates. High definition, interactivity, streaming. These are things that Disney is working on and Comcast is working on. The opportunity to do that as one company, to help regional sports, to help … Um … Ya know — we look at additional channels.

So I think it’s in a terrific position. And I’m sure there’s a tension that’s always occurred between cable operators and cable programmers, By being some of both, that’s very consistent with what Time Warner. That’s consistent with Newscorp. And consistent with a number of people that are in content and distribution.

But in the end, I think we can help those relationships with the industry to launch new product. And help understand — from a cable operator’s perspective — how is the best way to give access to that content that consumers really wanted? And — in their so doing — create the maximum value for ESPN and for the cable company. Yeah?

Q: Have you spoken with Roy Disney and have his impression on the deal at all?

A: No, we have not had any conversations with any of the Disney shareholders at this point.

Q: To the casual observer, could you give us some guidance on whether or not … How are you going to succeed where other mergers have failed, such as in AOL / Time Warner, Vivendi — Universal, etc.

A: Well, there are some good examples in life and some bad examples. We’d like to put AT&T/Comcast as a good example. As a stellar example of a merger. That has worked better than, I think, anybody. I think CBS and Viacom turned out pretty successful for the Viacom and the CBS shareholders. I think Time Warner and Turner was pretty successful and on a nice path. The couple examples that you mentioned … NBC is now trying to buy Universal, obviously, and USA Network.

So you’ve seen lots of transactions: Newscorp with Direct TV, Newscorp with buying Fox Studios. It comes down to people, execution and not getting ahead of yourself. And something that I think that — you know — you don’t set unrealistic expectations for yourself. You try to make it every year. We’ve been doing that with a long time. Our company — 15 years ago — was probably 1/20th the size of that we are today.

We’ve done a lot of acquisitions in cable and other businesses. Cellular, electric commerce and some of the things you’ve heard today. And I think we have a great track record.

But this is a whole new league, a whole ‘nother thing. We’re very respectful of it. We’re lucky to have Steve.

But — you know — you’ve gotta set realistic goals. And — as Steve said — a lot of the things that we will certainly work on, we’re not sitting there trying to quantify. And you want to start with a fair, balanced offer for both companies. So you give yourself a chance to be successful. Yeah?

Q: If this deal does not work out, what other properties or sorts of properties would you pursue and do you think are available to you? And — secondly — with the merged company remain in Philadelphia?

A: First of all, as with a lot of situations … You know, we wanna be successful. But we want to be disciplined and thoughtful about it. And we’ve walked away from big things before. On multiple occasions. We didn’t bid for Vivendi. We took a look. We didn’t buy Media One. So life goes on.

And that’s something that the grey hairs at our company are constantly reminding us all the time. There’s always another way. So I think that this is an offer. And I hope it’s very compelling. I see some non-grey hairs saying the same thing down there.

But I think that — frankly — that this is a very exciting possibility. And we wanted to see if it was something that Disney would consider. Merged company base? We’re still going to be in Philadelphia. But the Disney Company’s still gonna be in Los Angeles. And we gotta figure out how you operate.

But the reality is that we have something like 60,000 employees at Comcast. Less than a thousand are at the corporate headquarters in Philadelphia. We understand operating — from a cable company all the time and our programming company — and none of them are headquartered in Philadelphia. And I think the vibrancy of the Walt Disney Company in Los Angeles is pretty important on a go-forward basis and we will certainly continue that. Yeah?

Q: Hi. I think certainly an interesting transaction and a potential opportunity. However, your cost increase in the trading that I saw earlier and the shareholders don’t seem to be holding it as a value creation, at least initially. I think this may be twofold 1) the expectation among shareholders, I believe some of your larger shareholderswas that this was going to be a year to continue the integration of Broadband, AT&T Broadband, and work on building the broadband out and potentially collapsing. Secondfold, I think there’s some uncertainty regarding how this transaction works logistically. Could you speak to specifically how you anticipate the process going forward from here? Whether it’s through discussions for, directly with Disney shareholders, whether it’s through an intense solicitation, do you change the board?

A: There’s a lot of pieces to that. But let me just take a few of them and hopefully do the best I can.

Stocks go up and down. It’s not unusual — in the day that you announce that you’re doing something — that one stock to go up, one stock to go down. That’s pretty customary. That happened with every single thing Comcast has ever done. And yet — over 30 years — we’ve had double the S and P 500’s return to investors.

So there’s arbitration. There’s all sorts of things that happen. I don’t … I’m not surprised by that. I think that what you have to do is make a case for is this a great company that could be put together? This is the beginning of that process. I have no idea what happens next. I think that the ball is in the hands of the Disney board. And hopefully people will see that this is a great combination. In the back?

Q: If Disney chooses to negotiate, do you plan a consent solicitation?

A: Yeah, we’re just not gonna go with any of those comments today. So take it for what we’ve done today as a good day’s work. And we are hopeful to make this as friendly and amicable as possible, as quickly as possible.

I think that they have signaled that they are looking at succession issues. I think lots of people have written they would love to get Steve Burke back. Well, not only that, but you get 21.5 million customers. You get the rest of us. You get a great balance sheet. And you get 30 years worth of work.

SB: And $5 billion …

BR: And a $5 billion premium. Not a bad day.

Q: If this merger were to take place, how long do you think it would take? And what will consumers benefit?

A: Okay. Um, I think that these things tend to take about a year. You know, for … Maybe a little less. But typically, that’s what about AT&T Broadband took. That’s what Newscorp / DirecTV took.

I think what consumers get is very … is a great question. Is pretty fundamental.

First of all, consumers want to control … the Internet, to me, proves that consumers want to be able to control what they get, when they get it, how they get it. They want access to lots and they want to do it on their schedule. And there are billions and billions of websites that have thrived with giving people choice.

Comcast has all been about — since 1962 in Tupelo, Mississippi. Where the company got its first community antennae television system — was giving people more choice in television. Today, we offer hundreds of channels. Tomorrow, we want to give you video on demand.

We’ve doing video on demand in Philadelphia for about 9 months now,a year. We have 3000 hours plus of content available. Some of it’s NBC, some of it’s cable channels, some of it is HBO on demand, movies. Not a fully rich line-up. But it’s a start.

The average digital customer in Philadelphia inn the last month, January, half the customer used video on demand 13 times a month on average. We believe the way people interact with their television is absolutely going to change in the future. And consumers want to get the content …

Well, high definition sets are selling 10 to 20 thousand a week. High definition subscriptions. Broadband? We’re selling 30,000 hook-ups a week the last year. More than we thought and more than we did the year before.

The content — the richness of the sports, the movies, the news, ABC. All the wonderful content changing and being experimental. And moving windows, letting people have on their high definition TV sets. Yeah, you can get there eventually.

But if you’re in one company working together, it accelerates that. And I really believe that it’s a competitive world. We are trying to give the consumers choice. That’s who’s going to win.

We have satellite. 20 million homes in America bought a satellite dish. DSL from the phone companies competes with our high speed internet. Disney competes against other content companies. And the question is: By working together, can you make your products more desirable to customers? And then they’re going to take it.

Steve, you wanna add something to that?

Alright. Let’s do one more question. Ah … Over there in the corner.

Q: Steve, you talked about redundancies. Do you have projections of jobs eliminated and/or jobs gained in the merger?

A: No, we don’t have specific projections. What we mentioned was that there were about $300 to $400 million worth of cost reductions due to overlap. That represents — I think — less than 1% of the combined company and that overlap would be in very specific areas.

The vast majority of employees of both companies that work in the Disney parks or work in the ABC side of the business … By the way, we have great respect for many, many people. Many of whom I know at Disney and ABC and ESPN, There are wonderful people in that company.

This would not affect the vast majority of their employees nor would it affect ours.

Thank you very much, everyone.

Your thoughts?

General

Seward Johnson bronzes add a surreal, artistic touch to NYC’s Garment District

Greetings from NYC. Nancy and I drove down from New

Hampshire yesterday because we'll be checking out

Disney Consumer Products' annual Holiday Showcase later today.

Anyway … After checking into our hotel (i.e., The Paul.

Which is located down in NYC's NoMad district), we decided to grab some dinner.

Which is how we wound up at the Melt Shop.

Photo by Jim Hill

Which is this restaurant that only sells grilled cheese sandwiches.

This comfort food was delicious, but kind of on the heavy side.

Photo by Jim Hill

Which is why — given that it was a beautiful summer night

— we'd then try and walk off our meals. We started our stroll down by the Empire

State Building

…

Photo by Jim Hill

… and eventually wound up just below Times

Square (right behind where the Waterford Crystal Times Square New

Year's Eve Ball is kept).

Photo by Jim Hill

But you know what we discovered en route? Right in the heart

of Manhattan's Garment District

along Broadway between 36th and 41st? This incredibly cool series of life-like

and life-sized sculptures that Seward

Johnson has created.

Photo by Jim Hill

And — yes — that is Abraham Lincoln (who seems to have

slipped out of WDW's Hall of Presidents when no one was looking and is now

leading tourists around Times Square). These 18 painted

bronze pieces (which were just installed late this past Sunday night / early

Monday morning) range from the surreal to the all-too-real.

Photo by Jim Hill

Some of these pieces look like typical New Yorkers. Like the

business woman planning out her day …

Photo by Jim Hill

… the postman delivering the mail …

Photo by Jim Hill

… the hot dog vendor working at his cart …

Photo by Jim Hill

Photo by Jim Hill

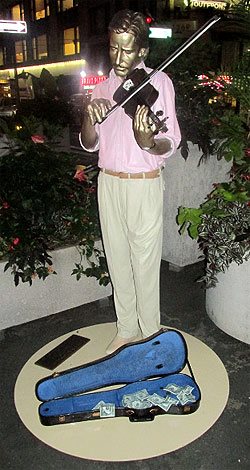

… the street musician playing for tourists …

Photo by Jim Hill

Not to mention the tourists themselves.

Photo by Jim Hill

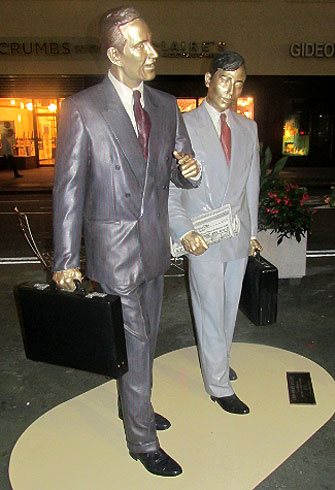

But right alongside the bronze businessmen …

Photo by Jim Hill

… and the tired grandmother hauling her groceries home …

Photo by Jim Hill

… there were also statues representing people who were

from out-of-town …

Photo by Jim Hill

… or — for that matter — out-of-time.

Photo by Jim Hill

These were the Seward Johnson pieces that genuinely beguiled. Famous impressionist paintings brought to life in three dimensions.

Note the out-of-period water bottle that some tourist left

behind. Photo by Jim Hill

Some of them so lifelike that you actually had to pause for

a moment (especially as day gave way to night in the city) and say to yourself

"Is that one of the bronzes? Or just someone pretending to be one of these

bronzes?"

Mind you, for those of you who aren't big fans of the

impressionists …

Photo by Jim Hill

… there's also an array of American icons. Among them

Marilyn Monroe …

Photo by Jim Hill

… and that farmer couple from Grant Wood's "American

Gothic."

Photo by Jim Hill

But for those of you who know your NYC history, it's hard to

beat that piece which recreates Alfred Eisenstaedt's famous photograph of V-J Day in Times Square.

Photo by Jim Hill

By the way, a 25-foot-tall version of this particular Seward

Johnson piece ( which — FYI — is entitled "Embracing Peace") will actually

be placed in Times Square for a few days on or around August 14th to commemorate the 70th

anniversary of Victory Over Japan Day (V-J Day).

Photo by Jim Hill

By the way, if you'd like to check these Seward Johnson bronzes in

person (which — it should be noted — are part of the part of the Garment

District Alliance's new public art offering) — you'd best schedule a trip to

the City sometime over the next three months. For these pieces will only be on

display now through September 15th.

General

Wondering what you should “Boldly Go” see at the movies next year? The 2015 Licensing Expo offers you some clues

Greeting from the 2015 Licensing Expo, which is being held

at the Mandalay Bay

Convention Center in Las

Vegas.

Photo by Jim Hill

I have to admit that I enjoy covering the Licensing Expo.

Mostly becomes it allows bloggers & entertainment writers like myself to

get a peek over the horizon. Scope out some of the major motion pictures &

TV shows that today's vertically integrated entertainment conglomerates

(Remember when these companies used to be called movie studios?) will be

sending our way over the next two years or so.

Photo by Jim Hill

Take — for example — all of "The Secret Life of

Pets" banners that greeted Expo attendees as they made their way to the

show floor today. I actually got to see some footage from this new Illumination

Entertainment production (which will hit theaters on July 8, 2016) the last time I was in Vegas. Which

was for CinemaCon back in April. And the five or so minutes of film that I viewed

suggested that "The Secret Life of Pets" will be a really funny

animated feature.

Photo by Jim Hill

Mind you, Universal Pictures wanted to make sure that Expo

attendees remembered that there was another Illumination Entertainment production

coming-to-a-theater-near-them before "The Secret Life of Pets" (And

that's "Minions," the "Despicable Me" prequel. Which

premieres at the Annecy International Animated Film Festival next week but

won't be screened stateside 'til July 10th of this year). Which is why they had

three minions who were made entirely out of LEGOS loitering out in the lobby.

Photo by Jim Hill

And Warner Bros. — because they wanted "Batman v

Superman: Dawn of Justice" to start trending on Twitter today — brought

the Batmobile to Las Vegas.

Photo by Jim Hill

Not to mention full-sized macquettes of Batman, Superman and

Wonder Woman. Just so conventioneers could then see what these DC superheroes

would actually look like in this eagerly anticipated, March 25, 2016 release.

Photo by Jim Hill

That's the thing that can sometimes be a wee bit frustrating

about the Licensing Expo. It's all about delayed gratification. You'll come

around a corner and see this 100 foot-long ad for "The Peanuts Movie"

and think "Hey, that looks great. I want to see that Blue Sky Studios production

right now." It's only then that you notice the fine print and realize that

"The Peanuts Movie" doesn't actually open in theaters 'til November

6th of this year.

Photo by Jim Hill

And fan of Blue Sky's "Ice Age" film franchise are in for an even

longer wait. Given that the latest installment in that top grossing series

doesn't arrive in theaters 'til July

15, 2016.

Photo by Jim Hill

Of course, if you're one of those people who needs immediate

gratification when it comes to your entertainment, there was stuff like that to

be found at this year's Licensing Expo. Take — for example — how the WWE

booth was actually shaped like a wrestling ring. Which — I'm guessing — meant

that if the executives of World Wrestling Entertainment, Inc. didn't like

the offer that you were making, they were then allowed to toss you out over the

top rope, Royal Rumble-style.

Photo by Jim Hill

I also have to admit that — as a longtime Star Trek fan —

it was cool to see the enormous Starship Enterprise that hung in place over the

CBS booth. Not to mention getting a glimpse of the official Star Trek 50th

Anniversary logo.

Photo by Jim Hill

I was also pleased to see lots of activity in The Jim Henson

Company booth. Which suggests that JHC has actually finally carved out a

post-Muppets identity for itself.

Photo by Jim Hill

Likewise for all of us who were getting a little concerned

about DreamWorks Animation (what with all the layoffs & write-downs &

projects that were put into turnaround or outright cancelled last year), it was

nice to see that booth bustling.

Photo by Jim Hill

Every so often, you'd come across some people who were

promoting a movie that you weren't entirely sure that you actually wanted to

see (EX: "Angry Birds," which Sony Pictures Entertainment / Columbia

Pictures will be releasing to theaters on May 20, 2016). But then you remembered that Clay Kaytis —

who's this hugely talented former Walt Disney Animation Studios animator — is

riding herd on "Angry Birds" with Fergal Reilly. And you'd think

"Well, if Clay's working on 'Angry Birds,' I'm sure this animated feature

will turn out fine."

Photo by Jim Hill

Mind you, there were reminders at this year's Licensing Expo

of great animated features that we're never going to get to see now. I still

can't believe — especially after that brilliant proof-of-concept footage

popped up online last year — that Sony execs decided not to go forward

with production of Genndy Tartakovsky's

"Popeye" movie. But that's the

cruel thing about the entertainment business, folks. It will sometime break

your heart.

Photo by Jim Hill

And make no mistake about this. The Licensing Expo is all

about business. That point was clearly driven home at this year's show when —

as you walked through the doors of the Mandalay

Bay Convention Center

— the first thing that you saw was the Hasbros Booth. Which was this gleaming,

sleek two story-tall affair full of people who were negotiating deals &

signing contracts for all of the would-be summer blockbusters that have already

announced release dates for 2019 & beyond.

Photo by Jim Hill

"But what about The Walt Disney Company?," you

ask. "Weren't they represented on the show floor at this year's Licensing

Expo?" Not really, not. I mean, sure. There were a few companies there hyping

Disney-related products. Take — for example — the Disney Wikkeez people.

Photo by Jim Hill

I'm assuming that some Disney Consumer Products exec is

hoping that Wikkeez will eventually become the new Tsum Tsum. But to be blunt,

these little hard plastic figures don't seem to have the same huggable charm

that those stackable plush do. But I've been wrong before. So let's see what

happens with Disney Wikkeez once they start showing up on the shelves of the

Company's North American retail partners.

Photo by Jim Hill

And speaking of Disney's retail partners … They were

meeting with Mouse House executives behind closed doors one floor down from the

official show floor for this year's Licensing Expo.

Photo by Jim Hill

And the theme for this year's invitation-only Disney shindig? "Timeless

Stories" involving the Disney, Pixar, Marvel & Lucasfilm brands that

would then appeal to "tomorrow's consumer."

Photo by Jim Hill

And just to sort of hammer home the idea that Disney is no

longer the Company which cornered the market when it comes to little girls

(i.e., its Disney Princess and Disney Fairies franchises), check out this

wall-sized Star Wars-related image that DCP put up just outside of one of its

many private meeting rooms. "See?," this carefully crafted photo

screams. "It isn't just little boys who want to wield the Force. Little

girls also want to grow up and be Lords of the Sith."

Photo by Jim Hill

One final, kind-of-ironic note: According to this banner,

Paramount Pictures will be releasing a movie called "Amusement Park"

to theaters sometime in 2017.

Photo by Jim Hill

Well, given all the "Blackfish" -related issues

that have been dogged SeaWorld Parks & Entertainment over the past two years, I'm

just hoping that they'll still be in the amusement park business come 2017.

Your thoughts?

General

It takes more than three circles to craft a Classic version of Mickey Mouse

You know what Mickey Mouse looks like, right? Little guy,

big ears?

Truth be told, Disney's corporate symbol has a lot of

different looks. If Mickey's interacting with Guests at Disneyland

Park (especially this summer, when

the Happiest Place on Earth

is celebrating its 60th anniversary), he looks & dresses like this.

Copyright Disney Enterprises,

Inc.

All rights reserved

Or when he's appearing in one of those Emmy Award-winning shorts that Disney

Television Animation has produced (EX: "Bronco Busted," which debuts

on the Disney Channel tonight at 8 p.m. ET / PT), Mickey is drawn in a such a

way that he looks hip, cool, edgy & retro all at the same time.

Copyright Disney Enterprises, Inc. All rights

reserved

Looking ahead to 2017 now, when Disney Junior rolls out "Mickey and the

Roadster Racers," this brand-new animated series will feature a sportier version

of Disney's corporate symbol. One that Mouse House managers hope will persuade

preschool boys to more fully embrace this now 86 year-old character.

Copyright Disney Enterprises,

Inc. All rights reserved

That's what most people don't realize about the Mouse. The

Walt Disney Company deliberately tailors Mickey's look, even his style of

movement, depending on what sort of project / production he's appearing in.

Take — for example — Disney

California Adventure

Park's "World of Color:

Celebrate!" Because Disney's main mouse would be co-hosting this new

nighttime lagoon show with ace emcee Neil Patrick Harris, Eric Goldberg really had

to step up Mickey's game. Which is why this master Disney animator created

several minutes of all-new Mouse animation which then showed that Mickey was

just as skilled a showman as Neil was.

Copyright Disney Enterprises,

Inc.

All rights reserved

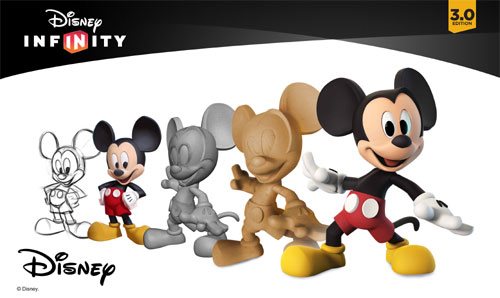

Better yet, let's take a look at what the folks at Avalanche Studios just went

through as they attempted to create a Classic version of Mickey & Minnie.

One that would then allow this popular pair to become part of Disney Infinity

3.0.

"I won't lie to you. We were under a lot of pressure to

get the look of this particular version of Mickey — he's called Red Pants

Mickey around here — just right," said Jeff Bunker, the VP of Art

Development at Avalanche Studios, during a recent phone interview. "When

we brought Sorcerer Mickey into Disney Infinity 1.0 back in January of 2014,

that one was relatively easy because … Well, everyone knows what Mickey Mouse

looked like when he appeared in 'Fantasia.' "

Copyright Disney Enterprises,

Inc. All rights reserved

"But this time around, we were being asked to design

THE Mickey & Minnie," Bunker continued. "And given that these Classic

Disney characters have been around in various different forms for the better

part of the last century … Well, which look was the right look?"

Which is why Jeff and his team at Avalanche Studios began watching hours &

hours of Mickey Mouse shorts. As they tried to get a handle on which look would

work best for these characters in Disney Infinity 3.0.

Copyright Disney

Enterprises, Inc. All rights reserved

"And we went all the way back to the very start of Mickey's career. We began

with 'Steamboat Willie' and then watched all of those black & white Mickey shorts

that Walt made back in the late 1920s & early 1930s. From there, we

transitioned to his Technicolor shorts. Which is when Mickey went from being

this pie-eyed, really feisty character to more of a well-behaved leading

man," Bunker recalled. "We then finished out our Mouse marathon by

watching all of those new Mickey shorts that Paul Rudish & his team have

been creating for Disney Television Animation. Those cartoons really recapture

a lot of the spirit and wild slapstick fun that Mickey's early, black &

white shorts had."

But given that the specific assignment that Avalanche Studios had been handed

was to create the most appealing looking, likeable version of Mickey Mouse

possible … In the end, Jeff and his team wound up borrowing bits & pieces

from a lot of different versions of the world's most famous mouse. So that

Classic Mickey would then look & move in a way that best fit the sort of

gameplay which people would soon be able to experience with Disney Infinity

3.0.

Copyright Disney Enterprises,

Inc. All rights reserved

"That — in a lot of ways — was actually the toughest

part of the Classic Mickey design project. You have to remember that one of the

key creative conceits of Disney Infinity

is that all the characters which appear in this game are toys," Bunker

stated. "Okay. So they're beautifully detailed, highly stylized toy

versions of beloved Disney, Pixar, Marvel & Lucasfilm characters. But

they're still supposed to be toys. So our Classic versions of Mickey &

Minnie have the same sort of thickness & sturdiness to them that toys have.

So that they'll then be able to fit right in with all of the rest of the

characters that Avalanche Studios had previously designed for Disney Infinity."

And then there was the matter of coming up with just the

right pose for Classic Mickey & Minnie. Which — to hear Jeff tell the

story — involved input from a lot of Disney upper management.

Copyright Disney Enterprises,

Inc. All rights reserved

"Everyone within the Company seemed to have an opinion

about how Mickey & Minnie should be posed. More to the point, if you Google

Mickey, you then discover that there are literally thousands of poses out there

for these two. Though — truth be told — a lot of those kind of play off the

way Mickey poses when he's being Disney's corporate symbol," Bunker said.

"But what I was most concerned about was that Mickey's pose had to work

with Minnie's pose. Because we were bringing the Classic versions of these

characters up into Disney Infinity 3.0 at the exact same time. And we wanted to

make sure — especially for those fans who like to put their Disney Infinity

figures on display — that Mickey's pose would then complement Minnie.

Which is why Jeff & the crew at Avalanche Studios

decided — when it came to Classic Mickey & Minnie's pose — that they

should go all the way back to the beginning. Which is why these two Disney icons

are sculpted in such a way that it almost seems as though you're witnessing the

very first time Mickey set eyes on Minnie.

Copyright Disney Enterprises,

Inc. All rights reserved

"And what was really great about that was — as soon as

we began showing people within the Company this pose — everyone at Disney

quickly got on board with the idea. I mean, the Classic Mickey that we sculpted

for Disney Infinity 3.0 is clearly a very playful, spunky character. But at the

same time, he's obviously got eyes for Minnie," Bunker concluded. "So

in the end, we were able to come up with Classic versions of these characters

that will work well within the creative confines of Disney Infinity 3.0 but at

the same time please those Disney fans who just collect these figures because

they like the way the Disney Infinity characters look."

So now that this particular design project is over, does

Jeff regret that Mouse House upper management was so hands-on when it came to

making sure that the Classic versions of Mickey & Minnie were specifically

tailored to fit the look & style of gameplay found in Disney Infinity 3.0?

Copyright Lucasfilm / Disney

Enterprises, Inc. All rights reserved

"To be blunt, we go through this every time we add a new character to the

game. The folks at Lucasfilm were just as hands-on when we were designing the

versions of Darth Vader and Yoda that will also soon be appearing in Disney

Infinity 3.0," Bunker laughed. "So in the end, if the character's

creators AND the fans are happy, then I'm happy."

This article was originally posted on the Huffington Post's Entertainment page on Tuesday, June 9, 2015

-

Film & Movies10 months ago

Film & Movies10 months agoBefore He Was 626: The Surprisingly Dark Origins of Disney’s Stitch

-

History8 months ago

History8 months agoCalifornia Misadventure

-

Film & Movies9 months ago

Film & Movies9 months agoThe Best Disney Animation Film Never Made – “Chanticleer”

-

Theme Parks & Themed Entertainment8 months ago

Theme Parks & Themed Entertainment8 months agoThe ExtraTERRORestrial Files

-

Television & Shows10 months ago

Television & Shows10 months agoThe Untold Story of Super Soap Weekend at Disney-MGM Studios: How Daytime TV Took Over the Parks

-

History9 months ago

History9 months agoWhy Disney’s Animal Kingdom’s Beastly Kingdom Was Never Built

-

Podcast11 months ago

Podcast11 months agoEpic Universal Podcast – Aztec Dancers, Mariachis, Tequila, and Ceremonial Sacrifices?! (Ep. 45)